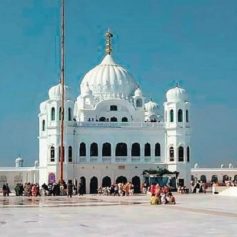

Tag: business news, kartarpur sahib, national news, RBI On Kartarpur Gurudwara, reserve bank of india

ਸ੍ਰੀ ਕਰਤਾਰਪੁਰ ਸਾਹਿਬ ਜਾਣ ਵਾਲੇ ਸ਼ਰਧਾਲੂਆਂ ਲਈ RBI ਦਾ ਵੱਡਾ ਫ਼ੈਸਲਾ, ਪੈਸੇ ਕੋਲ ਰੱਖਣ ‘ਤੇ ਲਾਈ ਇੰਨੀ ਲਿਮਿਟ

Dec 16, 2021 12:24 pm

ਭਾਰਤੀ ਰਿਜ਼ਰਵ ਬੈਂਕ (RBI) ਨੇ ਭਾਰਤੀ ਨਾਗਰਿਕ ਅਤੇ ਓਸੀਆਈ ਕਾਰਡਧਾਰਕ ਕਰਤਾਰਪੁਰ ਸਾਹਿਬ ਲਾਂਘੇ ਰਾਹੀਂ ਪਾਕਿਸਤਾਨ ਦੇ ਕਰਤਾਰਪੁਰ ਸਥਿਤ...

ਲਾਕਰ ਦੀ ਜਿੰਮੇਵਾਰੀ ਤੋਂ ਨਹੀਂ ਬਚ ਸਕਦੇ ਬੈਂਕ, 6 ਮਹੀਨਿਆਂ ‘ਚ ਜਰੂਰੀ ਨਿਯਮ ਬਣਾਏ RBI: ਸੁਪਰੀਮ ਕੋਰਟ

Feb 20, 2021 3:24 pm

SC directs RBI to lay down regulations: ਸੁਪਰੀਮ ਕੋਰਟ ਨੇ ਸ਼ੁੱਕਰਵਾਰ ਨੂੰ ਰਿਜ਼ਰਵ ਬੈਂਕ ਆਫ਼ ਇੰਡੀਆ ਨੂੰ ਬੈਂਕਾਂ ਵਿੱਚ ਲਾਕਰ ਸਹੂਲਤ ਪ੍ਰਬੰਧਨ ਨੂੰ ਲੈ ਕੇ 6...

ਮਾਰਚ-ਅਪ੍ਰੈਲ ਤੋਂ ਬਾਅਦ ਨਹੀਂ ਚੱਲਣਗੇ 100,10 ਅਤੇ 5 ਰੁਪਏ ਦੇ ਪੁਰਾਣੇ ਨੋਟ, ਪੜ੍ਹੋ ਪੂਰੀ ਖਬਰ

Jan 24, 2021 1:07 pm

Old Notes to be Withdrawn: ਇਹ ਖਬਰ ਸਿੱਧੇ ਤੌਰ ‘ਤੇ ਤੁਹਾਨੂੰ ਪ੍ਰਭਾਵਿਤ ਕਰ ਸਕਦੀ ਹੈ,ਪਰ ਘਬਰਾਉਣ ਦੀ ਕੋਈ ਗੱਲ ਨਹੀਂ, ਰਿਜ਼ਰਵ ਬੈਂਕ ਆਫ ਇੰਡੀਆ 100,10 ਅਤੇ 5...

RBI ਦੀ ਬੈਠਕ ਅੱਜ ਤੋਂ, ਮਹਿੰਗਾਈ ‘ਤੇ ਚਰਚਾ, EMI ‘ਤੇ ਰਾਹਤ ਦੀ ਉਮੀਦ

Oct 07, 2020 10:34 am

RBI monetary policy panel meeting: ਰਿਜ਼ਰਵ ਬੈਂਕ ਦੀ ਮੁਦਰਾ ਨੀਤੀ ਕਮੇਟੀ (MPC) ਦੀ ਬੈਠਕ 28 ਸਤੰਬਰ ਨੂੰ ਹੋਣੀ ਸੀ, ਪਰ ਆਖਰੀ ਸਮੇਂ ਇਸ ਨੂੰ ਮੁਲਤਵੀ ਕਰ ਦਿੱਤਾ ਗਿਆ...

ਰਿਜ਼ਰਵ ਬੈਂਕ ਫਿਰ ਘਟਾ ਸਕਦੈ ਵਿਆਜ ਦਰਾਂ, 0.25 ਫ਼ੀਸਦੀ ਦੀ ਹੋ ਸਕਦੀ ਹੈ ਕਟੌਤੀ

Jul 27, 2020 10:00 am

RBI may reduce interest rate: ਕੋਰੋਨਾ ਸੰਕਟ ਨਾਲ ਜੂਝ ਰਹੀ ਅਰਥਵਿਵਸਥਾ ਨੂੰ ਬਚਾਉਣ ਲਈ ਭਾਰਤੀ ਰਿਜ਼ਰਵ ਬੈਂਕ ਇੱਕ ਵਾਰ ਫਿਰ ਵਿਆਜ ਦਰਾਂ ਵਿੱਚ ਕਟੌਤੀ ਕਰ...